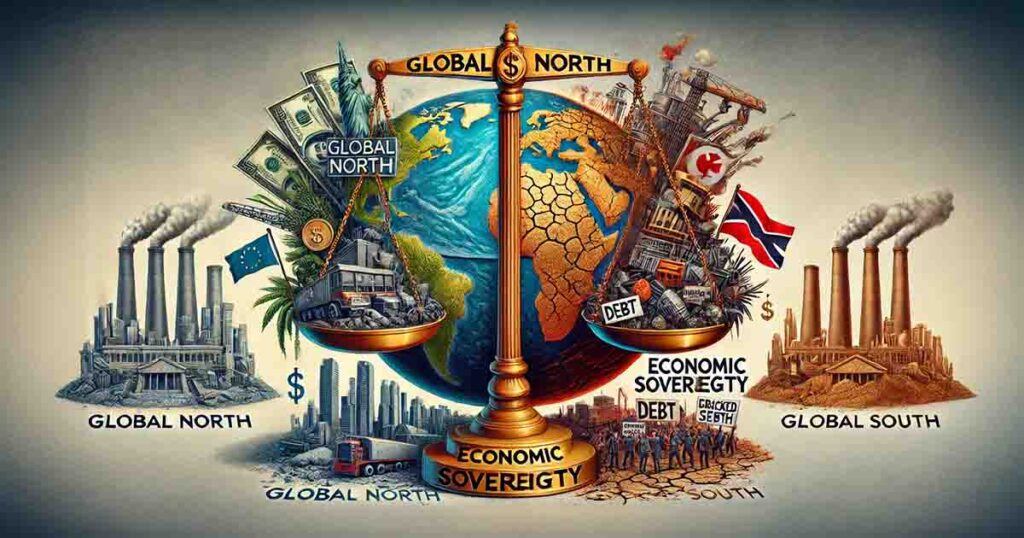

Developing nations are increasingly vocal about the strain imposed by contractionary monetary policies championed by Western financial institutions such as the International Monetary Fund (IMF) and World Bank. These policies, often promoted as solutions to economic instability, have led to widespread criticism for exacerbating global inequality, stifling growth in emerging economies, and disproportionately burdening vulnerable populations.

As the debate intensifies, this article explores the roots of this criticism, the impact of these policies, and the alternatives being proposed by the Global South.

Understanding Contractionary Monetary Policies

Contractionary monetary policies are strategies aimed at curbing inflation by reducing the money supply and raising interest rates. Common measures include:

- Increasing benchmark interest rates to control borrowing and spending.

- Reducing government spending and subsidies to balance fiscal deficits.

- Imposing stricter loan conditions to ensure financial discipline.

While these policies are effective in controlling inflation and stabilizing currencies in some cases, they often come at a high cost for developing nations.

Key Criticisms from Developing Nations

1. Stifled Economic Growth

- Developing nations argue that high-interest rates make borrowing for infrastructure, healthcare, and education prohibitively expensive.

- Contractionary measures often suppress demand, slowing growth in economies already struggling with low productivity and investment.

2. Social Impacts

- Budget cuts to public services such as education, healthcare, and social safety nets leave vulnerable populations worse off.

- Unemployment rises as businesses face higher borrowing costs, leading to widespread economic hardship.

3. Dollar Dependency and Debt Burdens

- Many developing nations rely on dollar-denominated loans. As Western central banks, particularly the U.S. Federal Reserve, raise interest rates, these debts become more expensive to service.

- Countries such as Ghana, Pakistan, and Sri Lanka have been forced into debt crises, requiring IMF bailouts that often come with stringent austerity conditions.

4. Unequal Power Dynamics

- Critics argue that Western financial institutions impose a one-size-fits-all model of economic management, ignoring the unique challenges and contexts of developing economies.

- These policies are often viewed as instruments of neo-colonialism, maintaining the economic dominance of the Global North over the Global South.

The Global Impact

1. Widening Inequality

Contractionary policies deepen global inequalities by hindering the growth of emerging markets while benefiting wealthier nations that can withstand higher interest rates.

2. Reduced Investment in Development

Developing nations are forced to prioritize debt repayment over critical investments in infrastructure, education, and climate resilience.

3. Increased Migration Pressures

Economic stagnation and unemployment in developing nations drive migration to wealthier countries, creating further geopolitical challenges.

Calls for Reform: What Developing Nations Demand

- Debt Relief and Restructuring

- Developing nations are advocating for debt forgiveness or restructuring to free up resources for development priorities.

- Proposals like the G20’s Common Framework aim to streamline debt restructuring but have faced delays in implementation.

- Alternatives to Austerity

- Economists and leaders from the Global South are pushing for policies that focus on stimulating growth rather than cutting spending.

- Investments in green energy, infrastructure, and education are seen as more sustainable pathways to economic stability.

- Reform of Global Financial Institutions

- Developing nations are demanding a greater voice in decision-making at the IMF and World Bank, which are often dominated by Western interests.

- Initiatives like the BRICS Bank (New Development Bank) represent efforts to create alternatives to Western-led financial institutions.

- Regional Cooperation

- Countries in the Global South are exploring regional trade agreements and currency swaps to reduce dependency on Western financial systems.

What This Means for the Global Economy

For the Global North

- While contractionary policies may stabilize Western economies, their spillover effects threaten global trade and investment opportunities.

- Ignoring the concerns of developing nations risks creating a more fragmented global economic order.

For the Global South

- The pushback against these policies represents a broader assertion of economic sovereignty and a call for a more equitable global financial system.

For International Relations

- The tension over economic policies reflects shifting power dynamics, with developing nations seeking greater agency in shaping global rules.

Conclusion: Toward a Balanced Approach

The criticism of Western contractionary monetary policies highlights a critical flaw in the global economic system: a lack of adaptability to the diverse needs of nations. Developing countries, bearing the brunt of these policies, are demanding change—not just in policy prescriptions but in the very architecture of global financial governance.

For meaningful progress, both the Global North and South must engage in dialogue to create solutions that balance economic stability with growth, equity, and sustainability. Only then can the global economy truly thrive in an interconnected world.